Get IRS Form 4506-T Done Right: Expert Tips to Avoid Delays & Mistakes

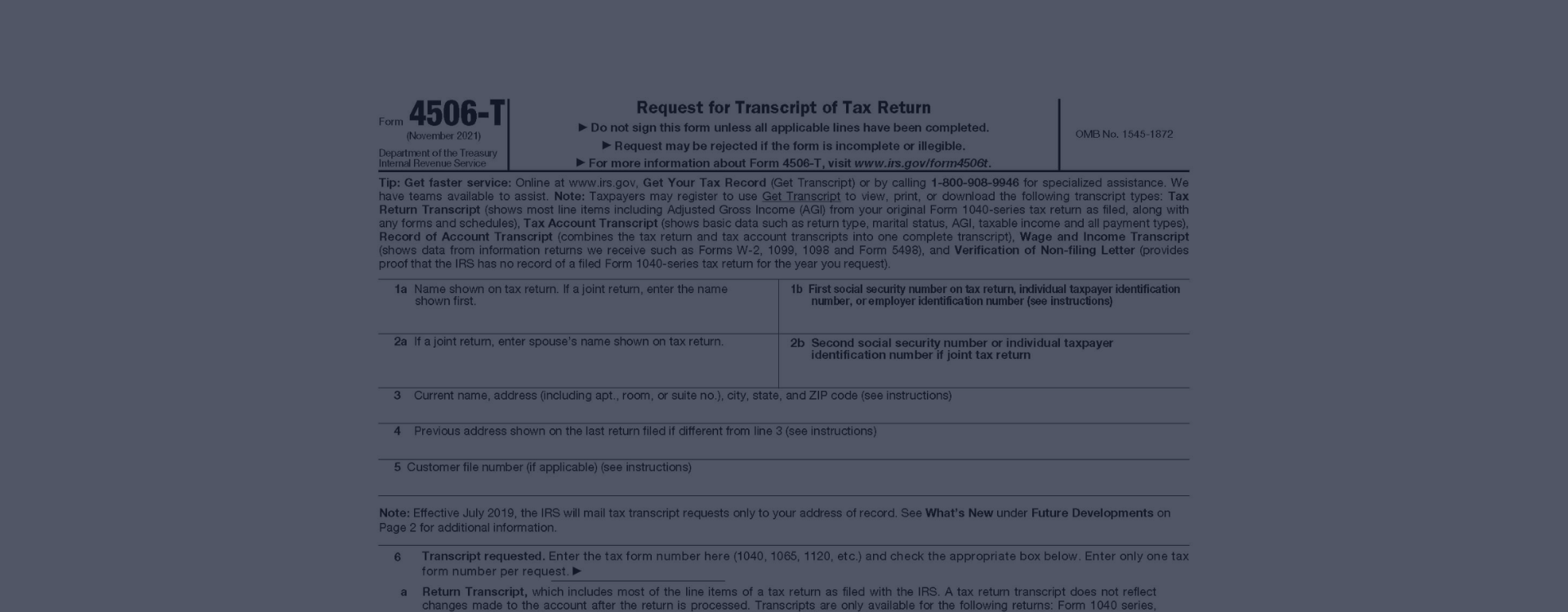

IRS Form 4506-T for 2022 is a crucial document taxpayers use to request a transcript of their tax return information. This document enables individuals and businesses to access various types of tax return transcripts, such as income, W-2, and 1099 records, among others. It is important to note that the IRS Form 4506-T instructions must be followed carefully to ensure accurate completion of the document, as any errors may result in delays or denial of your request.

Use Our Instructions & Checklists

One valuable resource for obtaining a blank IRS Form 4506-T and learning how to fill it out correctly is the website 4506t-form-print.com. This website offers comprehensive guidance on how to print IRS Form 4506-T, as well as detailed instructions and examples to help taxpayers easily complete the template. By utilizing the materials provided on this website, individuals and businesses can better understand the form and avoid common mistakes, ensuring a smooth and efficient process when requesting their tax return transcripts. The clear examples and step-by-step instructions make it an invaluable tool for anyone needing the 4506-T form to print and complete.

Conditions for IRS Form 4506-T Using

The IRS Form 4506-T, also known as the Request for Transcript of Tax Return, must be filed by individuals or businesses who need to obtain a copy of their annual returns information for various purposes. To help you better understand who might need to fill out Form 4506-T, let's take a look at two fictional characters and their unique situations.

Jane Doe, a successful entrepreneur, has recently decided to apply for a mortgage loan to purchase her dream home. The bank requires her to provide tax return transcripts for the past three years as part of the loan application process. In this case, Jane would need to download IRS Form 4506-T PDF, fill it out, and submit it to the revenue service to obtain the necessary documents.

On the other hand, John Smith, a freelance writer, has been selected for a random tax audit by the IRS. He misplaced his tax records from two years ago and now needs to present them to the auditor. John can use the printable tax form 4506-T PDF to request his annual return transcript from the IRS. By submitting this sample, John will be able to receive the required information and comply with the audit process.

4506-T Tax Form: Purpose & Assignment

-

![Verification Ease]() Verification EaseSimplifies the income verification process for loan applications, financial aid, and other purposes.

Verification EaseSimplifies the income verification process for loan applications, financial aid, and other purposes. -

![Fraud Prevention]() Fraud PreventionHelps detect and prevent identity theft, tax fraud, and unauthorized income reporting.

Fraud PreventionHelps detect and prevent identity theft, tax fraud, and unauthorized income reporting. -

![Tax Compliance]() Tax ComplianceAssists taxpayers in maintaining accurate records and staying compliant with tax laws.

Tax ComplianceAssists taxpayers in maintaining accurate records and staying compliant with tax laws.

IRS Form 4506-T PDF Structure & How to Fill It Out

Filling out a blank federal form 4506-T can be crucial for various financial processes, such as obtaining a mortgage, loan, or tax transcripts. Let's review some essential tips to help you complete this document accurately.

Firstly, ensure you have access to a Form 4506-T sample, which will provide you with a proper understanding of the form's layout and requirements. A free printable 4506-T form as PDF is available on our website, making it convenient for you to download and print.

When filling out the template, carefully input the necessary information in the appropriate boxes. This includes your name, Social Security Number, and address. Be cautious when entering dates and tax years, as errors in these fields are common.

To avoid mistakes, double-check the information provided, especially in sections 6 and 7, which specify the type of transcript and tax years requested. Pay close attention to the signature and date sections, as an incorrect or missing signature can result in a rejected request. Utilizing a Form 4506-T sample and carefully entering the required details will help you successfully complete the request. Remember to review your submission thoroughly before sending it off to ensure the best possible outcome.

Fill NowTerms of Submission

Taxpayers in the USA are required to fill out the 4506-T form online or using a printable template, which is essential for requesting transcripts of their tax returns. The deadline for filing this sample depends on the specific tax year and related requirements.

Those who fail to print the 4506-T form and submit it on time or provide false information may face significant penalties. These penalties can include monetary fines, interest charges, and even criminal prosecution in severe cases. Therefore, it is crucial to ensure taxpayers adhere to the deadlines and provide accurate data to avoid potential consequences.

Printable 4506-T Form

When obtaining a tax return transcript, filing the IRS Form 4506-T is the way to go. Two primary methods to file this copy are using a printable version or filing it online. Opting for a blank 4506-T form to print out has its advantages. For example, it allows you to physically review the document, make any necessary changes, and have a tangible copy for your records. IRS Form 4506T for print is also an excellent option for those who prefer a more traditional approach to filing tax forms.

4506-T Fillable Form

On the other hand, the benefits of online filing cannot be overlooked. By choosing to file 4506-T online, taxpayers can enjoy a faster and more efficient process. It eliminates the need for physical mailing, which reduces the chances of delays or lost documents. Moreover, an online filing system often comes with built-in error checks, providing an IRS Form 4506-T example to help ensure accuracy. This method mainly benefits those who value convenience and speed in managing their financial affairs.

File Online

IRS Form 4506-T Instructions

- What is IRS Form 4506-T, and when should it be used?This document allows taxpayers to request a transcript of their annual return information from the Internal Revenue Service. It’s commonly used when individuals or businesses need to provide proof of income, verify tax return details, or obtain a loan. For example, mortgage lenders often require a transcript of your tax return as part of the credit application process.

- How can I obtain a printable IRS Form 4506-T?To access and print tax form 4506-T, you can use our website. You can then download the blank template in a PDF format, which can be easily printed and filled out as needed. Otherwise, there is a handy editor where you can fill out the fillable template to e-file remotely.

- What information do I need to provide when completing a blank IRS Form 4506-T printable?You must provide your personal information, including your name, Social Security number or taxpayer identification number, and address. Additionally, you must specify the type of transcript you request (e.g., wage and income transcript, account transcript, or tax return transcript) and the financial years for which you need the information.

- How long does it take to receive my tax transcripts once I've submitted Form 4506-T?Once you have submitted your completed and signed printable IRS Form 4506-T to the appropriate address, it typically takes 10 to 30 days to process your request and mail the requested transcripts. Remember that the processing time may be longer during peak tax filing season.

- Is there a fee associated with requesting tax transcripts using Form 4506-T?The good news is that there is no fee for requesting tax transcripts. However, if you need a copy of your filed annual income return, you must submit Form 4506 (Request for Copy of Tax Return) instead, which does carry a fee.

More About Request for Transcript of Tax Return

IRS Form 4506-T Instructions Picture this: you're trying to obtain a loan or secure a mortgage, and suddenly you're faced with a mysterious document called the "IRS Form 4506-T." You might wonder what this form is all about and how to tackle it. Worry not, dear reader! This article will become your trusty guide to navigating th...

IRS Form 4506-T Instructions Picture this: you're trying to obtain a loan or secure a mortgage, and suddenly you're faced with a mysterious document called the "IRS Form 4506-T." You might wonder what this form is all about and how to tackle it. Worry not, dear reader! This article will become your trusty guide to navigating th... - 6 April, 2023

- IRS Form 4506-T Printable Version Guide Filing tax forms can be a daunting task, especially when it comes to understanding the intricacies of each form. One such document is the IRS Form 4506-T, which is used to request transcripts of your tax returns for various reasons, such as applying for a mortgage or obtaining financial aid for educ...

- 5 April, 2023

- Federal Tax Form 4506-T Ever struggled with understanding the complexities of tax forms and wondered if there is a simpler way to navigate them? Worry no more! In this article, we will unravel the mysteries of the Request for Transcript of Tax Return, making it easy for you to fill out the 4506-T form online and stay updat...

- 4 April, 2023

IRS Form 4506-T: Get Printable PDF & Instructions

Get FormPlease Note

This website (4506t-form-print.com) is not an official representative, creator or developer of this application, game, or product. All the copyrighted materials belong to their respective owners. All the content on this website is used for educational and informative purposes only.